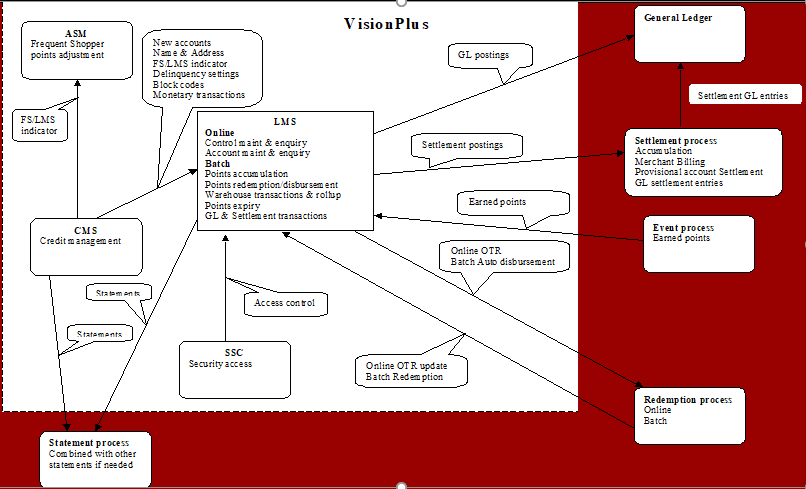

Let us take a look at Loyalty management system (LMS) popularly known as ‘Rewards’ system.

It is a system designed to allow card issuers to build a base of loyal customers by rewarding them with points or cash-back rebates according to their use of their card.

This is a VisionPLUS subsystem which presents a consistent look and feel as other VisionPLUS modules to maintain ease of use for operators and end users.

It is parameterized and enhanced (over CMS Frequent Shopper functionality) to provide maximum flexibility and tailoring from one loyalty scheme to another.

LMS System architecture:

Online

Control Record (System, Organization & Scheme records) setup

Account setup, Name locate

Points Balance inquiries, Transaction History

Add/Maintain/Inquiry of Points transaction

CICS callable function to allow external access by third-party redemption systems

Batch

Non-monetary maintenance

Points calculation and posting

Expired points processing

Auto-disbursement

Reporting

Redemption Transaction file

Event Based non-monetary Transaction file.

Account Status

Interfaces

Accepts incoming monetary transactions from CMS(AR System)

Accepts incoming non-monetary user input to add and maintain master file data in the new Loyalty system

Accepts incoming non-monetary transactions files from a third party source to allow event based processing

Accepts incoming points transactions for Loyalty accounts from a Third party redemption system.

Creates outgoing General Ledger transactions

Creates outgoing Settlement file

Creates outgoing file of points that have been redeemed

Creates outgoing file of information to support the production of customer reward statements by CMS / Statement system

Provides a real time interface to a third party redemption system

What is Scheme?

A loyalty Scheme is required to attract the account volumes required to create a substantial and profitable portfolio.

The Loyalty Scheme will define the basic parameters regarding the earning, redemption and expiry of points.

What is scheme structure ?

An Account can be enrolled into multiple Schemes.

Loyalty Scheme Name field allows greater flexibility when setting up scheme (as it is five alphanumeric field).

All the accounts will have at least Default group.

Both type of groups can have three types of Plans – Base, Supplementary & Override.

What is a Group ?

There are 2 types of Groups in LMS:

The default group of all ‘A’s is defined for each Scheme and controls the basic earned points awarded to an account and settlement with the Provision Account.

- Default group Organization specific.

- Each Store is linked to Default Group (as a minimum) to generate Basic Earned Points.

Bonus Groups control the allocation of bonus points to an account and settlement with the merchant.

- Multiple Stores participating in a Bonus Rewards Scheme constitutes Bonus group.

- A Store can be associated with multiple Groups

What is a Plan ?

LMS defines three types of points for each Group attached to a Scheme:

Base points that are allocated to a loyalty account as part of the standard features and offerings of the loyalty program.

Supplementary points that are offered in addition to the base points for a specific promotion/period.

Override points that are offered instead of the base and supplementary points. This could be used to offer double points for the month of November each time the card is used.

Rate table & Rate Tiers:

Allows to determine and to vary the ratio of points assigned to a transaction at the points Scheme level based on the monetary value of the transaction.

Provides a facility to enter a minimum value that must be present to qualify for a point.

Bonus point definitions (Bonus Groups) have the option to define different rates.

Enrollment:

New accounts can be setup automatically from an external interface, such as CMS/ CDM/SNAP, or directly from within the Loyalty system using online transactions.

Possible to add new accounts on a daily basis through the Loyalty system batch process.

LMS can generate account numbers automatically.

In Automatic mode, record is added in Account cross reference file, LMS Demographic data file and Points account file.

In Manual Mode also LMS account no. can be generated automatically.

Manual Setup can be used for creating multiple LMS accounts for One AR account.

AR/LMS Account Cross reference file will have to be updated manually (QPAX).

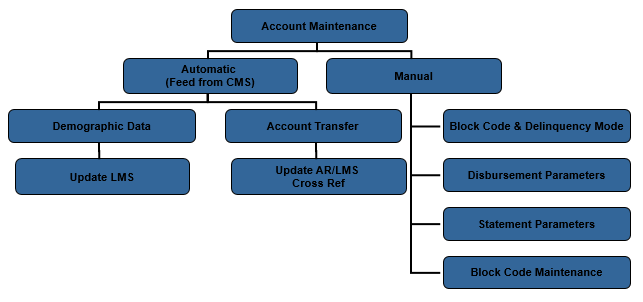

Account maintenance:

Account details can be maintained either via an external interface, typically from CMS, or via online maintenance within the Loyalty system.

LMS automatically handles account transfers without the need for manual processes in Loyalty.

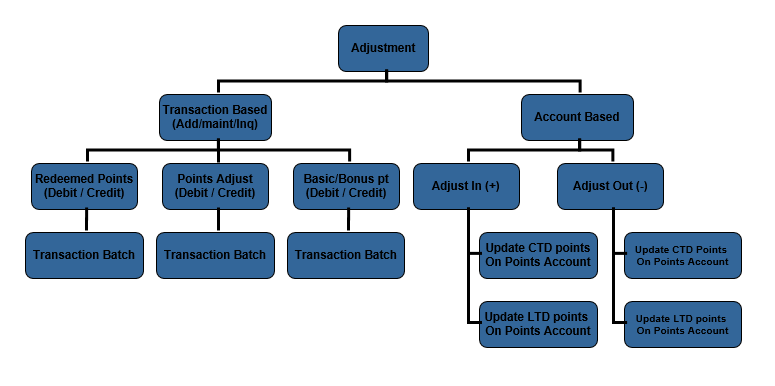

Adjustments:

Allows an operator to add, maintain or inquire upon batches of Point transactions.

The following types of transactions can be entered from these screens

Basic earned Points (debit or credit)

Bonus Points (debit or credit)

Redeemed Points (debit or credit)

Adjustment Points (debit or credit)

Manual Redemptions and redemption reversals.

Online transactions will be rejected online if

If the account is blocked or delinquent,

or for manual redemptions when the Open to redeem is less than the transaction amount he transaction will be rejected online.

Batch of ‘Adjustment Transactions’ is processed in the LMS batch.

If expired points need to be reinstated, the point’s adjustment transaction can be generated.

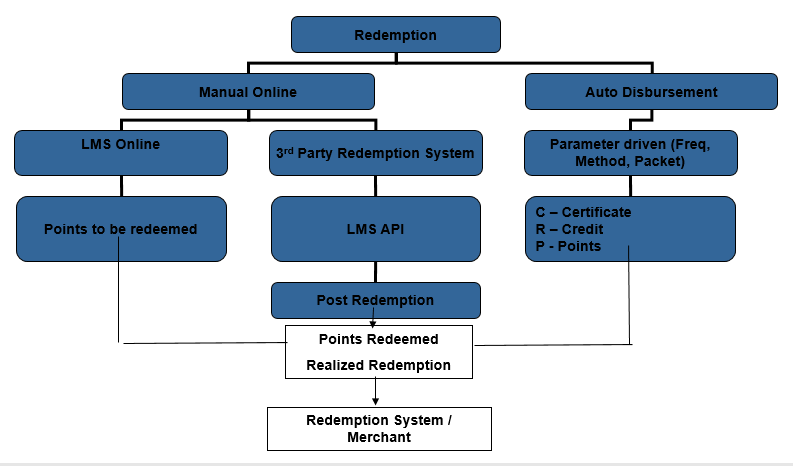

Redemption:

Redemption is the ability to allow a customer to redeem points. The points are redeemed in exchange for products or services

Oldest points will be redeemed first.

Accepts incoming file from a third party Redemption system

The block codes & Delinquency associated with the AR and or LMS account is checked before approval is given for redemption.

Online Redemption thru LMS can be done using Points Adjustment Function.

For 3rd Party Redemption System, there is standard Record layout.

Auto Disbursement Frequency can be set to determine the time of disbursement.

An AUTO DISBURSEMENT METHOD parameter will allow the operator to specify the method of disbursement, Check, Credit or Certificate (Voucher).

Auto Disbursement Packet can be set. It is the number of points automatically disbursed, if the account’s available points balance is greater than or equal to this number of points. If the value is Zero then all points will be disbursed.

Provides the ability to define the number of days before points will become eligible for redemption after being received by the Loyalty system, using the warehouse facility.

Facility to determine whether the Cycle to Date points are to be included or excluded from the Open to Redeem Points calculations.

No matching off process will take place between outstanding redemptions and incoming redemptions. It will be the responsibility of the third party Redemption system to provide a file of realized redemption points to the new Loyalty system.

Settlement:

It is a financial settlement that occurs between the Loyalty points funding participant, Issuer, and the Redemption channel.

Merchant Settlement

Merchant settlement is the process whereby the Merchant is charged for participating in Loyalty Schemes. Merchants can be charged for Bonus points and can be charged at the group or store level.

LMS allows to define:

Merchants, both group and store level.

Merchant settlement accounts.

Rate charged. Expressed as a percentage.

Settlement methods available will be Direct Debit, Invoice or both

Redemption Settlement

Redemption settlement is the mechanism to pay Redemption

merchants for services received by the financial institution on behalf their cardholders throughout the selected redemption period.

LMS allows to define:

Redemption settlement accounts

Settlement with different redemption merchants at settlement intervals

Different dollar rates for redemption merchants.

Manual adjustment of redemptions for settlement purposes.

General Ledger:

For each points transaction processed, a monetary equivalent is calculated and then posted to the

General Ledger.

LMS allows to define :

General Ledger account numbers for debit and credit accounts for every monetary value processed by the system.

a percentage rate for the monetary equivalent value of a point and tax rates applicable.

Two sets of General Ledger entries are produced during LMS processing:

Provisioning :

Provisioning GL relates to the scheme owner putting money aside to cover the cost of points.

Merchant Settlement :

Merchant Settlement GL relates to requesting money from participating merchants for points awarded for customer transactions originated through the merchant.

Settlement General Ledger :

LMS will produce a single settlement GL file containing general ledger entries for merchant settlement for inclusion into the third party General Ledger System.

LMS allows to define :

Debit and Credit GL Accounts

Rate Percentage. The rate at which points are equated to a monetary value.

The provisioning General Ledger entries are system generated as a result of point’s calculation processes within LMS.

They represent monetary commitment for the points earned.

LMS allows to define :

Transaction code and description

Debit and Credit GL Accounts

Rate PCT

Tax Rate

for provisioning General Ledger

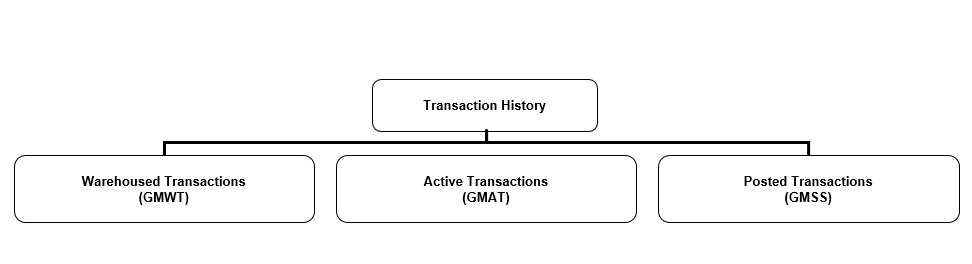

Transaction History:

Warehouse transactions – this screen will display all monetary transactions where the points are yet to be calculated and posted.

Active transactions – this screen will display the point transactions that have been calculated and posted but either the account has not statemented and/or the transactions have not been settled

Transactions history – this screen will display all point transactions that have posted, statemented on the loyalty account and settled with the merchant

Wildcard search feature (*) is allowed.

Transactions can be searched for on account number, Scheme, Merchant DBA, Merchant Id number, batch number, batch date or AR account number.

Period between Expiry of Points & Removal from the Transaction History file can be specified for a Scheme.