In CMS, a Batch process is required to post Monetary transactions (like sale/payment, debit/credit adjustments or refunds etc) as well as Non Monetary transactions (like change of address or telephone number) to the customer’s account, calculate date-driven delinquency, calculate finance charges and late fees, generate statements, and other functions. The batch process is streamlined and capable of processing large account bases within compressed nightly batch windows. During the batch process, all master files are closed to online maintenance so that the batch update can occur. To accommodate certain data processing requirements, Vision PLUS enables the credit staff to access and/or manipulate cardholder account data after the master files are closed and batch processing begins (in the after hours mode).

The batch processing of accounts can be classified into 2 broad categories as:

- Non monetary batch flow

- Monetary batch flow

Non Monetary Batch Flow

At any point of time, if the card holder would like to change his/her details in the master files of the Issuer bank, he/she can call up the Customer Service Centre (also called ASM or Account Service Management) of the Issuer Bank and request for the required change.

E.g.: Address, Telephone number etc.

These changes are directly updated to the original master files through the online by the customer service representative and a log file (AML1 file that is extracted as ATL1 using the ARD020 program in batch) will be maintained with the before and after value of each of the changed fields. This activity would be performed online for the specific accounts requested for.

On the other hand, if the issuer bank would like to do bulk changes of field values for bunch of accounts, instead of updating through online transactions, they are created through a User input file (ATUD) and then fed into the batch for updating the master files.

E.g.: Postal code of a city changes, Name of a city changes etc.

Here it is important to make sure that the User provided ATUD files are pre-edited before they are fed in the nightly batch to update the master files.

ARU040 (Non Monetary User Input Pre-edit):

ARU040 program will do the pre-edits of all the non-monetary User inputs.\

All the non monetary user inputs are fed into the system through ATUD (Disk)/ ATUT (Tape) files and they are pre-edited by the program ARU040.

Some examples of pre-edits are:

- If the input record is an “Add New Account” and the account exists on either the AMBS or the AMBI (Inactive Account Base Segment) files, the program rejects the input record.

- If the input record is a maintenance function to an existing account and if the account is not on the Account Base Segment file or on the inactive file (if the maintenance is base segment maintenance), the program rejects the input record.

- The input record can also be rejected based on the Field Security Level record for this organization and security user code, or if the data input is not valid for this field.

- Also, if the value of the field being changed is identical to the value input, the program does not generate a maintenance record.

All valid records that have passed the pre-edit are written into the ATUI file and for all the error records a detailed invalid report is generated. The pre-edits are done only for records that belong to AMNA, AMBS, AMED, AMPS, AMPM, AMLS files, and all other file records are bypassed from the pre-edit.

ARU040 is composed of various dynamically called programs. Each of these called programs pre-edit respective files and pass on information to ARU040. These programs are specifically named as ARU040XX, where XX stands for the file name acronym.

E.g.: ARU040BS: (Account Base Segment User Non-Monetary Pre-edit) will be called from ARU040 for AMBS file pre-edit.

ARU040NA: (Name and Address User Non-Monetary Pre-edit) will be called from ARU040 for AMNA file pre-edit.

ARD040 (File Maintenance Journal):

The actual non-monetary maintenance happens in the ARD040 program.

The valid ATUI file from ARU040 is fed as input to ARD040 program, and this program updates the actual master files when it is run in the user-input mode. It also generates the detailed report with before and after values of fields that are updated online, provided it is run in the journal mode (the input file in this mode will be ATL1 which is extracted from AML1 using program ARD020).

ARD040 can be run in three modes – JOURNAL, UPDATE U & UPDATE.

JOURNAL mode – generates report of all non monetary updates that have happened through online. That means all online accepted non monetary transactions in the input ATL1 file, that affects any of the master files will be reported.

UPDATE U mode – Updates the master files using ATUD (Disk File)/ ATUT (Tape File).

In the Update U (also called as user-input mode), the program can do selective updates on CMS master files. In this mode, the program opens only the AMBS, AMEC, AMED, AMNA, AMPM, and AMSC files for direct updates. Corresponding updates are made to AMNK (Name Key File) and AMBX (Customer to Base Segment Cross reference file), if applicable. Also it creates different output files like ATNU (Name Key Update File), ATTS (Promotion Statistics Tag File), ATO1 (CTA Tag Maintenance File), ATNM (Daily Name/Address Maintenance File), ATFR (Fraud Report File) which can be used by other subsystems for different purposes.

UPDATE mode – Is used for disaster recovery (Reload files from backup – ABTF). The update mode can be used for data recovery operations. In this mode, the valid transactions that are resident on the AML1 file will be applied to the concerned CMS master files during the execution of ARD040.

ARD040 is composed of various dynamically called programs. Each of these called programs processes and passes print file information to ARD040 in both the update and journal modes. These programs are specifically named as ARD040XX, where XX stands for the file name acronym.

E.g.: ARD040BS: (Account Base Segment Record Maintenance Journal) will be called from ARD040 for AMBS file maintenance.

ARD040NA: (Name and Address File Maintenance Journal) will be called from ARD040 for AMNA file maintenance.

ARU780 (Name Key Update):

The ATNU (Name Key Update File) file created by ARD040 will be fed as input to ARU780 program which handles Alpha search Update. It rebuilds AMNK (Name key file) and AMBX (base customer XREF file) files. AMNK file is used to locate a customer by giving first few alphabets of the name using the online ARNL transaction. Rebuilding of this file is required when there are changes in Name and Address file AMNA.

Monetary batch flow

Monetary transactions are those which affect balances of CMS accounts. Monetary transactions are typically authorized and input by tape or electronic transmission. Other monetary transactions are input using CMS batch transactions (E.g.: Batch of transaction details that the Merchant submits to the bank). These transactions do not affect the balances until a batch processing run is completed. Monetary transactions can be fed to the system mainly through online or through batch.

ARAT/ARAP transaction can be done online which will add a record to the AMT1 file that will be fed to the nightly batch cycle for processing. A few monetary transactions that could be applied through online could be interest adjustment, fee adjustment, re-entering rejected batches, adding payments etc.

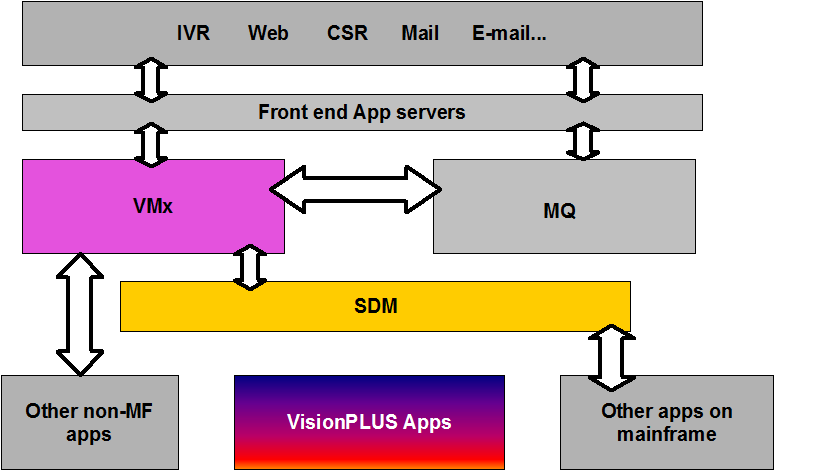

On the other hand, the ATTD (Disk)/ATTT (Tape) batch feed will come through TRAMS (Transaction Management System). TRAMS will receive the settlement file from the network that would contain all the monetary transactions that were processed during the day in the network (Master or Visa).

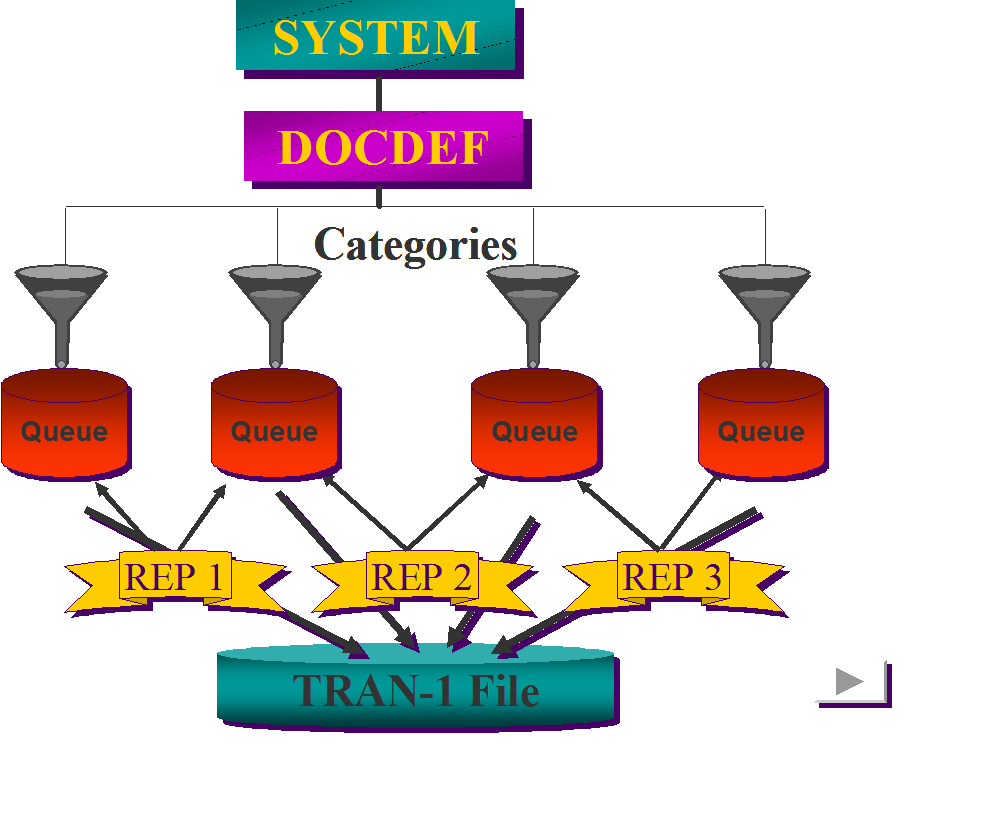

All the monetary transactions are processed in batches and there can be only one batch processed per organization in the batch, hence maximum number of batches would be 99998 in any batch cycle. A batch of transaction consists of a header that contains the batch number, sum totals of all transaction items and debit and credit amounts that are included in the batch, and records of the individual transactions and details. During the daily run, CMS matches the contents of the batch with the batch header. If the batch header does not match with the content, CMS rejects that batch. Either the batch header or the batch will need to be corrected to balance the batch, before CMS will process it.

Monetary transaction flow in CMS is handled by the following programs. The AMT1 file is processed through the following set of programs.

1) ARD020: Online Transaction Extract

2) ARD080: Transaction Edit Merge

3) ARD100: Sort Transactions to Posting

4) ARD140: Posting

5) ARD180: Monetary History Update

6) ARD185: Multiple Reject Processing

7) ARD200: Build Reject Reentry

The ATTD/ATTT file from TRAMS is initially processed through the following set of programs:

- ARD010: TRAMS monetary balancing report

- ARD011: Sort ATTD file for CMS

- ARU080: Monetary user input pre-edit

The output of ARU080, ATTI file is fed to ARD080 along with ATT1 created by ARD020 and the processing continues from ARD080 through ARD200.

ARU020 ( Master file backup/reload):

Program ARU020 is used to take backup or reload all master files. The backup will be taken into tape file ABMF. This is a control card driven program in which we can specify options for backup/reload as well as the file for which we need to perform the operation. If something goes wrong during the batch or for any other reason, if it is required to restore all the master files as is before the batch, ARU020 would be run in the reload mode and using the ABMF as the input file, all the master files would be restored.

ARD020 ( Online Transaction Extract ):

Program ARD020 extracts all online monetary transactions that were fed through ARAT/ARAP screens throughout the day. All these transactions will be added to the AMT1 file. Also we have the rejected monetary transactions form the previous day’s batch in the AMJ1file, the transferred transactions in AMXT file. This program extracts all these files and will create output transactions files ATT1, ATJ1 and ATXT.

Also this program takes the backup of all the transaction files into tape file ABTF. This tape backup ABTF can be used to reload the transaction files in later stage if required .This Backup and reload process is driven by setting the control card parameters.

ARD060/ARD065 (Date Roll/Date Roll Account):

All the master files in the system have a date and/or timestamp in the header record. In the batch run, all the master files are updated with current system date and time on which the batch is running.

User can make the system bump to any future date by giving a future date in the control card. This would not happen in a normal production environment but would be required in the Test Environment for testing specific functionality (like testing delinquency, calculating future interest etc).

Otherwise the system will increment the date by one from the current date in the AMCR file.

ARD060/ARD065 programs will handle the date roll in CMS. This will update all the files with correct processing date for the system and the organizations. ARD060 does the date and time stamp updates for non segmented master files i.e. the control files. (E.g. AMCR) ARD065 does the date and time stamp updates for all the account based master files. (E.g. AMBS, AMNA etc.,)

ARD011 (Sort monetary file from TRAMS):

Program ARD011 sorts the monetary transaction coming from TRAMS and writes into ATTD file and pass the file to program ARU080. ARD011 sorts the records in the correct sequence i.e. batch headers at the top followed by the transaction records. The monetary data from the ASM system is formatted in ATTD layout and passed into ARU080 program for further processing.

ARU080 (Monetary User Input Pre-edit):

Program ARU080 handles the pre-edit of monetary transactions from the user input files (ATTD, ATTT or both) which are coming from different sources like TRAMS/ ASM, merges the files and writes all valid transactions into ATTI file. It produces a report, listing valid and invalid batches and transactions and corresponding error messages. ATTI file is then passed to program ARD080.

ARD080 (Transaction Edit/Merge)

Program ARD080 merges all monetary transactions and creates the files ATE1 (transactions in error are moved to ATE1), ATNS (all the New Sale transactions are moved to ATNS) and ATVT (all other Various Transactions are moved to ATVT). All balanced batches will be written into ATBB file and imbalance batches into ATIB file.

It merges the following files:

ATT1 (today’s transactions from the online system)

ATJ1 (reject reentry items from the online system)

ATTI (user input)

AMWT (warehoused monetary transactions)

ATXT (today’s transfer transactions)

ARD100 (Sort transactions to posting)

ARD100 sorts & merge all monetary transactions from ATNS & ATVT and creates ATPT (Posted Transactions File) which will be used as input for posting program (ARD140).

ATNS contains all new sales transactions and ATVT contains all the various transactions.

A delete define step runs that will delete and define all the temporary master files.

The intermediate copy step copies the Insurance history master file to the temporary insurance history file.

ARD140 (Posting)

ARD140 is the Posting program with multiple functions.These functions include posting transactions to customer accounts,examining each account for reportable conditions, generating the necessary report tag records, producing statement records , calculating fees assessed by the system , accrues the interest, applies the payments to the system, sends accounts for collections and many other tasks.

Program ARD140 does the posting of monetary transactions using ATPT as input and updates the master files.Also ARD140 generates several transactions for assessing fees, billing interest, interest adjustments etc and post to the customer accounts.These generated transacations will be available in the ATGT file created by ARD140.It updates the posting flag in ATPT and ATGTfiles with any value ranging from 00 to 99. If the posting flag is other than zero, then it signifies that the transaction hasn’t been posted to the system. A transaction can be rejected (for many reasons) or warehoused.. These transactions

ARD140 is a driver program which calls many sub modules like D140ATPT,D140DELQ, D140INT, D140LM30 etc to handle different types of tasks in posting. Each copybook has a prefix of D140 and a 3 or 4 character file name (such as AMBI) or function name (such as INS). For example D140AMBI is the inactive account processing copybook and D140INS is the Insurance processing copybook. ARD140 is the top level routine and controls the overall processing flow, performing the various functions as necessary.

ARD170 (Shopper Program Control Records Update)

ARD170 updates the Frequent Shopper statistics that are accumulated as part of the program after multiple postings are run. ARD170 updates the Frequent Shopper Program (AMSP) control file using records in the Shopper Profile Update (ATSP) file.

ARD175 (Sort ATGT and create ABGT Backup)

ARD175 sorts and backs up the generated transactions which are created by posting in the generated transaction ATGT file.

ARD180 (Monetary History Update)

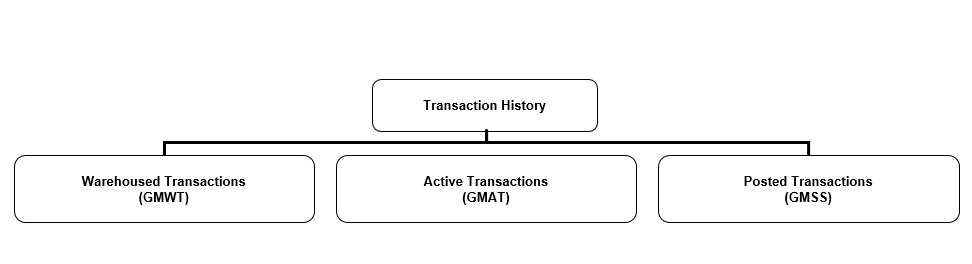

ARD180 processes the various monetary transaction files after they have been processed by the posting program ARD140. It distributes these items to various output files depending on whether the:

- Transaction was posted or non-posted.

- Transactions are to be printed in a statement run today.

The program reads each of the four input files – ATGT, ATPT, ABAI and AMDI.

Depending on the posting status and the statement status, the transaction will be routed to either of the five output files:

- a) Unapplied or nonposted transactions from the ATPT file are routed to the ATTA file.

- b) Monetary transactions from both ATPT and ATGT files to be warehoused are routed to the AMWT file.

- c) Accumulated history back up transactions are routed to the ABAO file. This file contains all posted transactions from the ATPT file, the ATGT file, and the ABAI file for those accounts not printing on statements today

- d) Statement monetary transactions are routed to the ATST file. This file contains the same transactions as the ABAO file described above for those accounts printing on statements today. It also contains any disputed items from the AMDI file for the indicated accounts.

- e) Unstatemented posted monetary transactions are routed to the AMOS file.

ARU060 (Initialize Transaction Files)

ARU060 program initializes the transaction files of the system. It initializes the files like AMJ1, AML1-4, AMM1, AMT1, AMXT, AMOM, AMBM, AMOM, AMBM, AMOM, ATTD, ATTT, ATUD and ATUT to make them ready for the next day update/processing.

ARD185 (Multiple Reject Processing)

ARD185 takes all those transactions, that are rejected by posting for multiple reasons and generates Multiple reject records in the ATM1 file. (one record each for each reject reason). This will list the multiple reasons because of which an account got rejected in posting. This will be useful when we correct the rejected transactions thru online for Reject re-entry.

It uses various input files (AMHB / AMMC/ AMBI/ AMBS/ AMCR/ AMDI/ AMOA/ AMPS/ AMRT) to create ATM1 and the program also updates the ATTA file.

ARD190 (Build Multiple Reject AMM1 File)

ARD190 creates the Multiple Reject AMM1 file with one record each for every reject reason using ATM1(temporary multiple reject reasons) file as input. It also generates the Multiple Reject Report.

ARD200 (Build Reject Reentry)

ARD200 loads the rejected transactions from the day’s batch run to the Reject Master (AMJ1) file. It also generates the Reject Reentry Batches Report. It uses AMCR, ATTA and ATE1 as input and generates AMJ1 and takes the tape backup in the Rejected Transactions Backup file ABJ1. These rejected transactions can be corrected thru online ( ARMT) baed on the reject reasons so that they can come into the system in the next days batch processing.