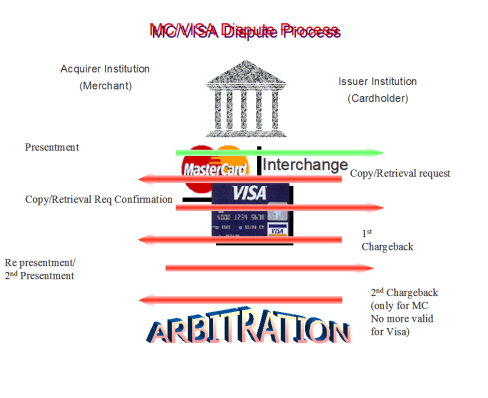

ITS is used to track Incoming & Outgoing Visa & MasterCard Interchange items.

Role of ITS:

Outgoing Activities for Issuer

» Copy Request

» Chargeback

» Misc Fee Claim (Funds Disbursement/Fee Claim)

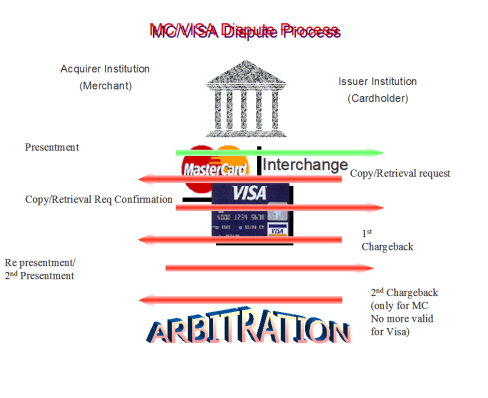

ITS is used to track Incoming & Outgoing Visa & MasterCard Interchange items.

Role of ITS:

Outgoing Activities for Issuer

» Copy Request

» Chargeback

» Misc Fee Claim (Funds Disbursement/Fee Claim)

CMS and HCS work together to provide commercial card processing and reporting. HCS provides management of the company structure and account creation as well as reporting in the form of organization level reports and interfaces to Master card Smart Data and VISA INFOSPAN.

The structure of HCS depends on a business’s organizational chart. Each entity in HCS is considered a “node”. A node could be a company, a cost center, or an individual account. A company can have up to 99 levels and up to 999,999,999 reporting units which could be representative of a division, department, cost center etc. HCS can also support up to 999 products (CMS Logo).

Account Node – Represent individual accounts and are attached to reporting nodes. This node is always the lowest level of the hierarchical structure, but can be attached to any reporting node, regardless of level. An account node can represent an actual cardholder, or it can represent a billing account used by CMS sweep processing provides the account processing and passes transaction and account information to HCS.

The Hierarchy Company System (HCS) is an application that provides a company hierarchy structure for processing commercial cars and managing the relationship between the company, the sublevel reporting within the company, and the individual commercial card accounts.

HCS supports multiple hierarchical levels, multiple card products, statement processing, reporting, letters, and transfers for each company.

HCS interfaces to the Credit Management System (CMS) to obtain transaction activity and provide accounts-receivable information.

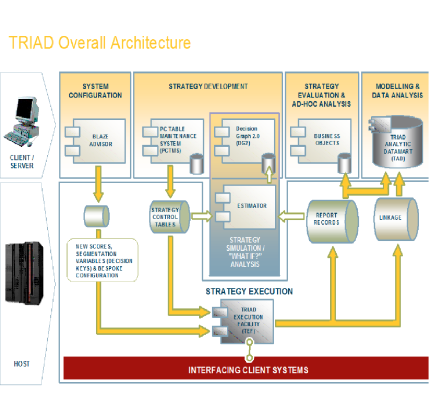

FICO® TRIAD® is the world’s leading credit and deposit customer risk management solution, helps deliver profits. TRIAD’s closed loop decision improvement process drives long-term profit growth at lower risk through a unique combination of analytics, simulation, champion/challenger testing, and unmatched strategy consulting. More than 65% of all customer credit card decisions worldwide are automated and improved with TRIAD.

Credit card processing companies, like other companies, must make a profit or go out of business. To achieve this goal, they charge fees.

These fees can be numerous. This can lead to some irritation. As in: What is all this stuff?

In the belief that knowledge is power, heres a quick breakdown of what all that stuff is.

Application Fee

Generally speaking, reputable companies do not charge this fee. They dont need to. They get enough business without charging up-front. Application fees are, by and large, bogus.

Startup Fee

Some work is involved in setting up a credit card processing account. A startup fee in the range of $25 can be justified, as long as the system thats set up works great.

Statement Fee

Credit card processing companies usually provide detailed statements at the end of each billing cycle. These statements show how many credit cards were processed, the times and dates of the swipes, good stuff. The organization of that information has value. So they charge for it.

A statement fee of seven to ten dollars per month is common.

Monthly Minimum

Credit card processing companies take a percentage of each transaction, so if no transactions are occurring, theyre not making any money. For this reason, they may put a andquot;monthly minimum not metandquot; charge into the contract. That way, they are assured of some revenue from each account.

Discount Rate

The discount rate is the primary fee charged by credit card processing companies. It is customarily between 1.5 and 2 percent of each transaction.

Charge Back Fee

Refunds complicate matters. If credit card transactions are repeatedly being charged back and forth, and the credit card processing company is being asked to void transactions after the fact, and so on, a charge back fee may occur.

Often, a certain number of charge backs are allowed per month before this fee kicks in.

Gateway Fee

This fee is related to the ability to process Internet credit card transactions. In order to do that, a credit card processing firm must provide some basic Web site services, such as a shopping cart function for the customer and/or a portal that lets the client accept and monitor payments.

A gateway fee in the neighborhood of ten dollars per month is common.

Termination Fee

Typical contract lengths are between one and three years, with early termination fees ranging from one to three hundred dollars. There are credit card processing providers who do not charge a termination fee. However, that may mean they charge a bit more in other areas.

How Much Is Too Much?

As a general rule of thumb, processing credit cards is a great deal if the cost is at or around two percent of total credit card purchases. If $100,000 of credit card purchases flow through a restaurant per month, processing credit cards might cost $2,000 per month.

When offers are flying around at less than that, be wary. Remember: credit card processing companies have to pay fees too, to the credit card companies themselves.

Without that two percent or so, credit card processing companies dont have a business.

Sources

Forbes